ev charger tax credit 2022

Jan 13 2022. The federal tax credit could rise to 12500 from 7500.

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

The federal tax credit was extended through December 31 2021.

. Currently the federal government offers a tax credit for both EV charger hardware and for installation costs. By Andrew Smith February 11 2022. Just buy and install.

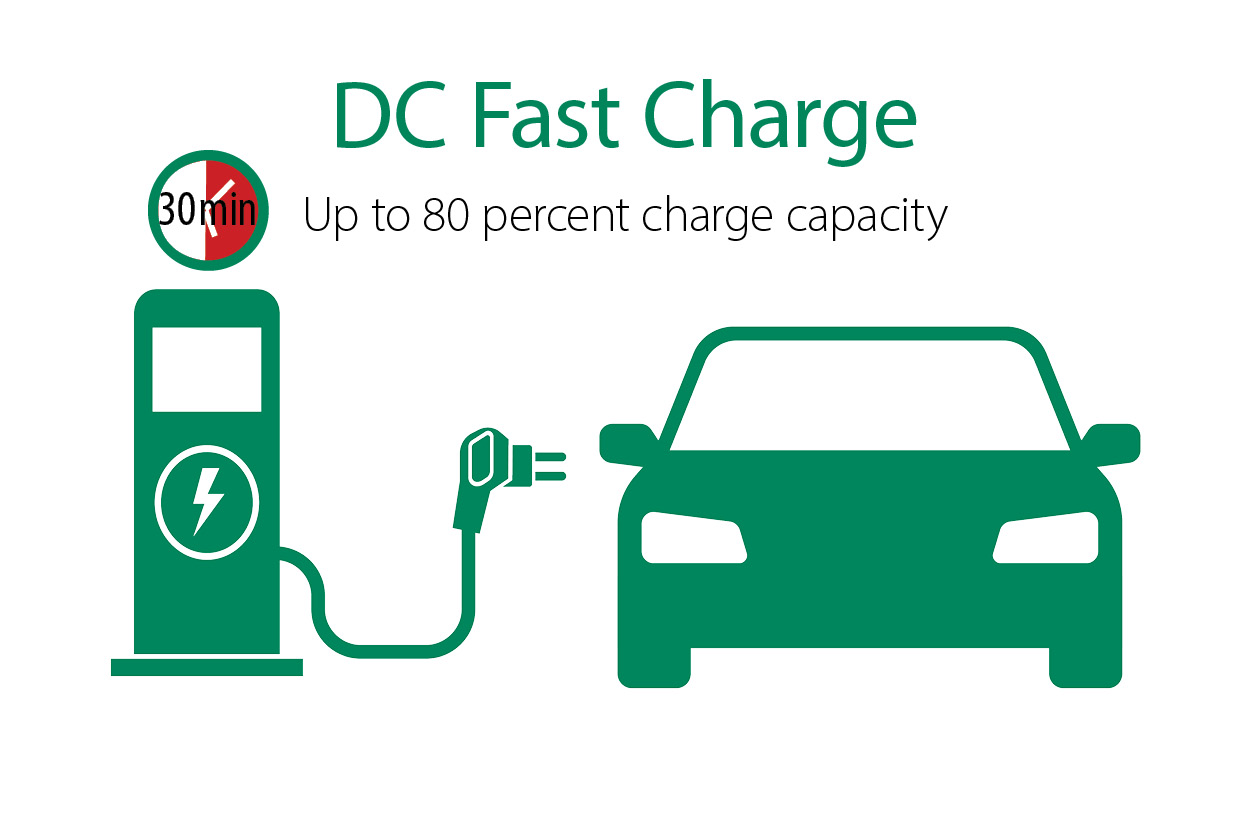

Black Hills Energy Commercial customers are eligible for a rebate up to 2000 per port for Level 2 chargers or up to 35000 for the installation of DC fast chargers. SUBJECT Electric Vehicle Charging Station Tax Credit SUMMARY This bill under the Personal Income Tax Law PITL and the Corporation Tax Law CTL would. Level 2 charger between January 1 2022 and December 31 2022.

Residential installation can receive a credit of up to 1000. The tax credit covers 30 of a companys costs. However this credit has a deadline of december 31 2021 and may decrease in 2022 so its recommended that companies looking to install ev charging systems do so before that.

Up to 1000 Back for Home Charging. The goal of the CalCAP Electric Vehicle. Many EVs these days have a 100 kWh.

This means that you can bring. The credit begins to phase out for a manufacturer when that manufacturer sells. However unless the Electric car is constructed in the United States employing union workers the sum is decreased.

For example new EV purchasers may qualify for up to 750 in state tax credits in California in 2022 under the California Clean Fuel Reward program. The new tax credit starts with a base amount of 4000 as it is today with another 3500 available if the vehicles battery pack includes at least 40 kwh of capacity for cars. Alternative Fuel Vehicle AFV and Fueling Infrastructure Tax Credit State EV Charging Incentive.

California adds 1500 incentive for new EVs total state fed incentives now up to 135K. 58 rows The federal EV tax credit may go up to 12500 EV tax credit for new electric vehicles. Information specific to your.

As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. The 30 off or up to 1000 tax credit for EV residential charger installations was extended to Dec 31 2021. The Federal EV Charger Tax Credit program offers a rebate of 1000 per site.

The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs. A rather significant federal tax benefit is available to most taxpayers who recently installed electric vehicle. The Federal Goverment has a tax credit for installing residential EV chargers.

The credit amount will vary based on the capacity of the. The federal government offers a tax credit for EV charger hardware and EV charger installation costs. Federal income tax credit of up to 7500 for eligible all-electric and plug-in hybrid cars purchased new in or after 2010.

Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial. For residential installations the IRS caps the tax credit at 1000. An EV with at least a 5 kWh battery capacity can snag you another 417 plus another 417 for each kWh above that 5 kWh threshold.

695 million for developing EV charging infrastructure in Washington for rural areas multifamily housing office buildings schools and other public location. Co-authored by Stan Rose. The federal tax credit starts at a minimum of 2500 and can go up to 7500 depending on the cars traction battery capacity and gross vehicle weight rating.

This incentive covers 30 of. The tax credit covers 30 of a companys costs. Federal tax credit gives individuals 30 back on a ChargePoint Home Flex EV charger and installation costs up to 1000.

The credit ranges between 2500 and 7500 depending on the capacity of the battery. Unlike some other tax. It covers 30 of the costs with a.

As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. The tax credit is retroactive and you can apply for. Will EV charging installation tax credit continue into 2022.

Rebates And Tax Credits For Electric Vehicle Charging Stations

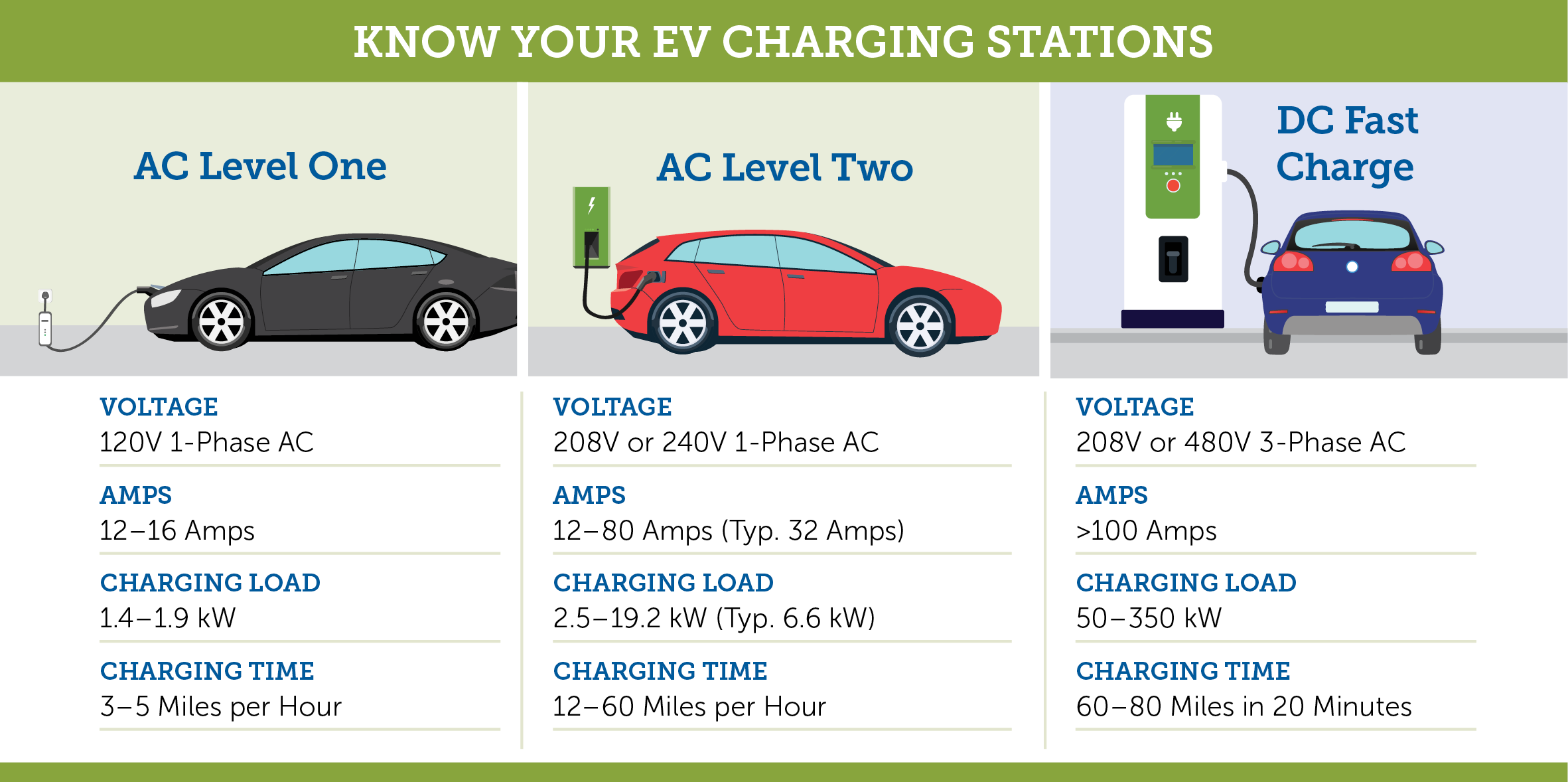

What Are The Ev Charger Levels

About Electric Vehicle Charging Efficiency Maine

What Are The Different Levels Of Electric Vehicle Charging Forbes Wheels

Ev Charging Tacoma Public Utilities

Best Level 2 Ev Charger Compare Chargepoint Juice Box Grizzl E Siemens Blink More

How To Choose The Right Ev Charger For You Forbes Wheels

Electric Vehicle Charger Installation

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

2022 Ev Charging Incentives For New England Revision Energy

What S In The White House Plan To Expand Electric Car Charging Network Npr

Find Charging Options For Your Electric Vehicle Carolina Country

Tax Credit For Electric Vehicle Chargers Enel X

Ev Charging Stations 101 Wright Hennepin

How To Claim An Electric Vehicle Tax Credit Enel X

How To Develop An Ev Charging Station Finder App Features Cost

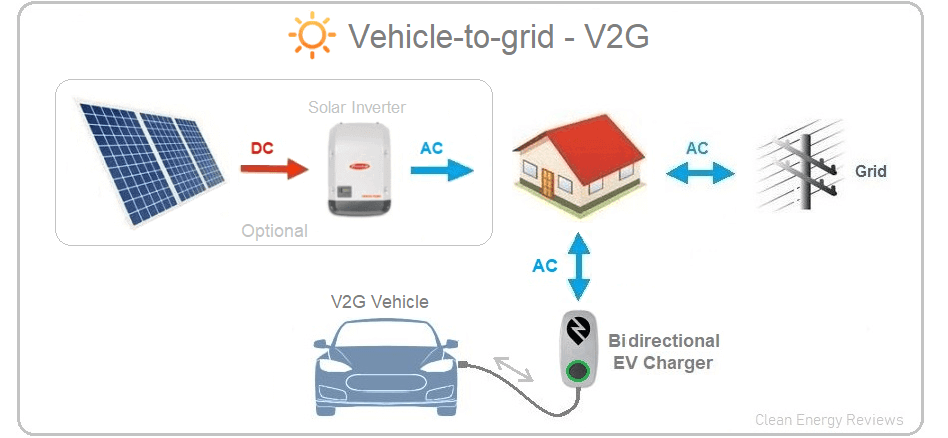

Bidirectional Chargers Explained V2g Vs V2h Vs V2l Clean Energy Reviews